The Cost of Culture: When Alignment Determines Success or Failure

It’s been a year since my last post, and time has absolutely raced by. My last post was titled “The Unattainable Property Pole,” and that pole has only risen higher.

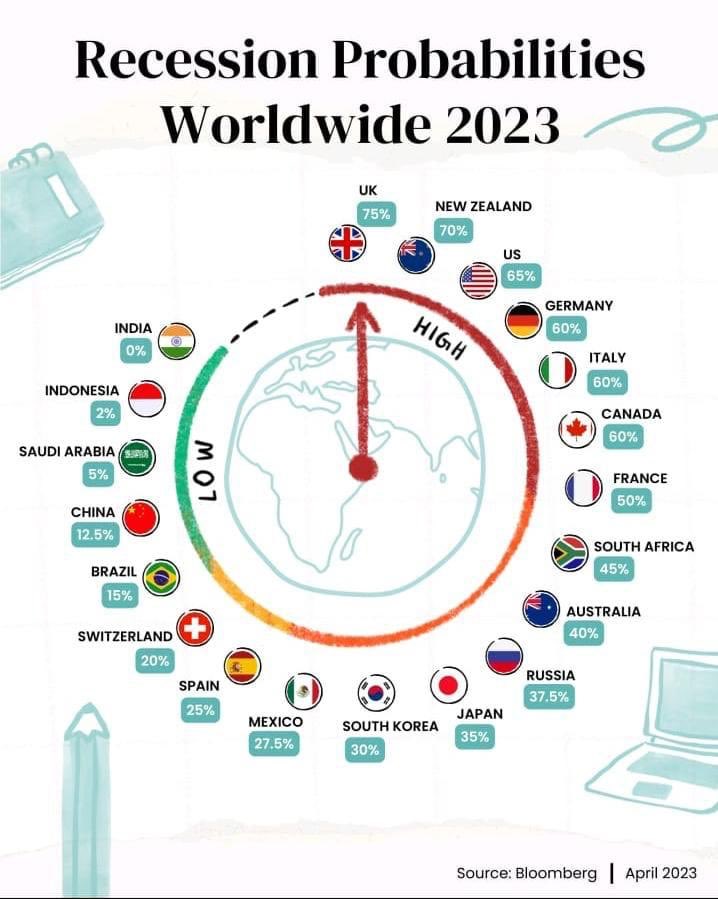

In my previous post on “Good Fellas Way,” I explored key economic and investment trends shaping the current landscape. From persistent inflation and stable employment rates driving a longer interest rate cycle in Australia and the USA, there were signs of economic weakness in China and Europe, and the global outlook looked complex. Locally, I delved into the challenges younger generations face in entering the property market and questioned the sustainability of traditional investment property returns.

I shared insights into my personal portfolio strategy, highlighting cautious optimism around speculative investments and the concentrated investment in ASX small medtech company Imricor Medical Systems (more on this later).

Indulge me for a few minutes as I deviate from the usual rant on what’s happening with investing and the macro economy.

I want to share a personal story with you, one that has shaped my life over the past year. As I entered my early 50s, I began to feel the weight of the daily grind in Sydney. My wife and I were feeling worn out by the constant hustle and bustle, and we longed for more space and a relaxed atmosphere. We had just completed a three-year renovation during the COVID pandemic, which was quite the journey. But if I’m honest, the pandemic changed the world in many ways. It showed us that working from home is possible, at least for professionals. This realization got me thinking: could we have the best of both worlds? Could we maintain our professional careers, stay close to our clients, and support our staff?

After some careful consideration, we concluded that it was possible, but with a few key factors in mind. First, we needed to live within a two-hour drive of Sydney, and ideally, have a residence in the city for when we needed to be there. So, after months of scouting the north coast of Sydney, we found our new home at Lake Macquarie, NSW. We sold our Sydney home and bought in Lake Macquarie, but I knew we needed a Sydney pad to make it work. This led me to merge our tax practice with a larger firm to have the capital for both a house and an apartment. I wasn’t retiring; I was just as active post-merger as I was before, and I absolutely wanted to continue working with you, our clients.

Everything seemed to be going well, or so I thought! The saying “slowly then suddenly” played out in real time for me. We did our due diligence, narrowing down from over 30 firms to the successful bidder, People and Partners. We believed we had found a good cultural fit. My senior staff were involved in the decision-making process, but ultimately, the responsibility rested with me. I am fiercely loyal to our staff, and we truly have amazing people, led by Elizabeth Mayer (née Allan), Sandy Wang, and Nisha Pasteur, along with our dedicated accountants and support staff.

But, just six months in, conflicts and communication breakdowns began to take their toll. The management styles were very different; our existing business had a very flat structure and was super cohesive, while the new business was overly hierarchical. The larger firm’s focus on budgets and targets had our staff concentrating on forecasts, profit margins, and cost savings, rather than on clients. This was the exact opposite of our way of doing business: “Look after your clients, and your clients will look after your business.”

I knew where this would end. We could continue, but ultimately it wouldn’t work. Our amazing staff would leave, and most importantly, our clients would suffer disruption. This was something I could not let happen because I care for each and every client and want the very best for YOU. So, I decided to buy back the business eight months later. I think I just had my “you only get one Alan Bond in your life” moment.

With the same team and a back-to-the-future approach, it’s business as usual from NOW. Many of you might not be aware or feel any difference, and that is perfect for us. But some key points moving forward: we have new digs at the amazing space of The Commons, 39 Martin Place. Be sure to come and visit us soon. Our emails will revert back to insightmp.com.au, and our phone numbers will remain the same.

My last word on this… you must try and learn from every experience, good or bad. Of course, you learn ten times more from the challenges than you do from your successes. A few points come to mind that I think are worth sharing for business owners. Firstly, be very cautious about business partnerships with PE firms that want 51% of your business; you will soon become captive and then a slave. Second, and I always say this to clients, begin with the end in mind and have a plan for failure.

So what matters? It’s the people, and they must come first. That is clients then staff at and the principal or business leader a distant third.

OK, enough of this… it’s time we get back to investment themes, insights, and what are the next moves on how to grow your wealth. This is my passion and how I can genuinely help you beyond business advice. Over this past year, I have had a deep look at the investors I know or follow and what made them so successful. I was lucky enough in 2018 to gain a new client, “Charlie L”, a successful fund manager in the UK and Australia, and when looking at his approach and his performance, it became obvious that patient capital matters.

When I look at my 25-year audited SMSF investment returns and compare them with my personal investments in my own name or trust, well, let me say I am more than a little embarrassed. My average SMSF return has averaged 18% vs a personal return of sub 5% (at best). The key difference is your mindset, knowing that I could not access my super until well into my 60s, I subconsciously had a long-term approach. Let’s be clear, long-term is not 3 years; it is 7 to 10 years. To verify this long-term approach is real performance vs theoretical performance, I noted that I had some of the same assets both in super and personally, and when reviewing the transactions, the short-term nature just killed my returns for my personal holdings. In essence, the in-out and chasing the next thing, reading the press or news wires, and reacting just leaves you nowhere.

So let’s give an update on what’s happening now in markets. We are living in extraordinary times. The pace of change, the intensity of disruption, and the deep undercurrents reshaping our institutions and values all point to something larger than a news cycle or market trend. We may well be in the midst of what historians call a Fourth Turning—a period of upheaval that recurs every four generations, where old systems are tested and new paradigms are born. These are the moments that define eras, forge leaders, and demand clarity of purpose. This isn’t a time for passive observation. It’s a time for awareness, courage, and thoughtful action. A brief background on what is the 4th turning. The Fourth Turning: An American Prophecy by William Strauss and Neil Howe represents a compelling vision of history as a repeating cycle of four distinct phases. These phases—High, Awakening, Unraveling, and Crisis—each last about two decades and shape the course of society. The authors argue that we are currently in a Fourth Turning, a time of profound upheaval that will redefine institutions and social structures before a new era begins. Throughout history, similar periods have led to revolutions, wars, and dramatic cultural shifts. This theory has sparked debates and influenced discussions on generational change, suggesting that the challenges we face today are not random, but part of a larger historical rhythm. Whether one sees it as prophecy or pattern, it’s a fascinating lens through which to view our world and its future. I have read this book; it’s heavy reading, but you could always download the audiobook. I thoroughly recommend it. In fact, I am currently listening to the sequel “The Turning is Here”.

The point of identifying the 4th turning is to consider how we might invest over the next 8-10 years. You can see just in the last month or so the volatility with equity markets down 18% in April only to recover this in May. I think it is worthwhile we keep a close watch on the global debt burden by country, with a particular focus on the US debt, which sits large and feels like a looming crisis lays ahead. There is a saying in financial markets that the bond traders are the smartest in the room, and I totally agree, having worked on a bond desk for 6 years, then a currency desk and equity desk for the next 10 years. It’s the deep thought on interest rates and inflation that really matter to the global economy.

What’s happening right now is that U.S. bond traders are pushing 10-year bond yields higher. The reason? Despite Donald Trump campaigning on the importance of reducing debt and deficits—arguing that the U.S. can’t afford the growing interest bill—his policies are sending mixed signals.

The interest on U.S. debt is forecast to exceed $1 trillion by 2026. By 2027, it’s expected to match Social Security spending and become the single largest government expense.

Trump now finds himself in a bind: he has promised tax cuts for the low- and middle-income brackets while also pledging to get the national debt under control. His strategy was a two-pronged approach:

- The Elon Musk-inspired DOGE experiment, which initially claimed it could save $3 trillion.

- Tariffs on global trade, dubbed “Liberation Day,” intended to generate revenue.

The goal was to fund tax cuts for the bottom 85% of taxpayers, which would, in theory, stimulate economic growth and increase tax receipts—especially from corporations and the top 10% of earners, who currently contribute 76% of all tax revenue. On paper, this could work.

In essence, Trump’s plan relies on the rest of the world footing the bill for U.S. tax cuts and debt reduction. Credit where it’s due: this wasn’t Trump’s idea alone. The architect behind it is U.S. Treasury official Scott Bessant, known as the brains behind Soros Fund Management.

However, the strategy is now unraveling. The DOGE savings were vastly overestimated—coming in at under $200 billion, which only covers about 60 days of interest payments. The impact of the tariffs is also uncertain, and no one really knows how global trade will respond under this regime.

To be fair to Elon Musk, the real savings lie in major spending categories like Social Welfare and Defense, which were off-limits to DOGE.

The government’s latest strategy is to try to outgrow the cost of debt by boosting GDP growth to 3%. But with current GDP at just 1.9%, that’s a narrow and risky path—hence why bond traders are pushing yields higher.

So yes, we have risks, but there are always risks in markets. Sadly, I have a view that we are in for more volatility. It is hard to see how the S&P follows on from 2023 and 2024 combined 50% gains. What we want to do is be nimble and alert to take advantage of the volatility.

I have taken a view that I want to play thematic themes for investing with the 7-10 year cycle. One of those themes is global Nuclear Energy, and I have built a basket of shares to invest in this strategy. I wasn’t looking for miners or the commodity, but rather I want the entire valuation chain of the industry. Yes, I have a small allocation in miners and the commodity, but the edge is in everything else. Call it lucky, but this thematic just got a kick up the bum with a rainbow as Trump signed executive orders revitalizing the Nuclear Energy Sector. This basket is up well over 50% in the last 6 weeks alone, but think of where this would be in 7-10 years. It’s not 50%; it’s 10 to 20 times this.

Another thematic basket I am running is a natural gas basket. My time horizon on this is 5-8 years, and it will capture the energy needs between coal and nuclear. Natural gas prices have averaged $2.50 over the past 10 years and currently sit at $3.40, but with increasing demand and growth forecasts as high as $6-$7 over the next 10 years, this seems a sensible position.

Moving to the next real life-changing thematic is AI, but if you are thinking Nvidia and AMD or chips, then this is wrong. That theme has played out. Instead, I am looking at AI Phase 2. Which industries and companies are really going to benefit from AI through productivity? Which companies hold a moat to apply AI to its customers and exponentially grow? This is a genuine 10-year investment, but in my view, this is a 10-20 times return.

Carrying on from AI Phase 2 is the biotech sector. This is such an unloved, beaten sector, and I see significant upside in this sector. I actually see this sector outpacing in a much shorter time frame, maybe 3-5 years. Again, I have built a basket of biotech shares for inclusion in my strategy.

Last but not least, I am right now looking at establishing a robotics theme. It’s early days, and it somewhat crosses over with the AI story, but like the nuclear and AI Phase 2, it’s the nuance of the basket to get the right allocation that matters. It’s a lot of work and a lot of reading, but it is what I absolutely believe in how to invest in today’s world.

Disclaimer: I can’t do this work on my own, and I do subscribe to Citrini Research, and I must give credit to this service. The research is deep and complex. I don’t follow the research blindly but have my own overlays and allocation models.

OK, let’s wrap this up. Long-term readers will know that I have been an extreme BULL on two key stories: firstly, Bitcoin, and secondly, Imricor Medical Systems. Well, Bitcoin is up 72% from my last post in May 24, and Imricor is up a whopping 300%. If you are a client, you would have indeed had me in your ear on the compelling buy story for Imricor. So what is my view today on these two holdings?

Earlier I mentioned the 4th Turning and the debt cycle. In my opinion, Bitcoin is a genuine asset and alternative to money debasement, as is gold. I think every portfolio should hold at least 5% in this asset, and you should think of this as a generational play.

Imricor, I remain even more bullish today on this share than any time prior. It has a unique, only-in-the-world innovative MRI-guided solution for heart surgery. It has growing global demand for advanced cardiac care, and it is opening up new markets with its Northstar Technology. It now has strong financial performance, with sufficient capital at the bank that likely sees it not return to the market for more capital. The commencement of the VISABL-VT trial is a significant strategic milestone, potentially leading to broader adoption of their technology. It is my opinion that this share can 10 to 20 times from here over the next 7-10 years.

THESE TWO HAVE NEVER WORKED IN BUSINESS

Let me finish with this absolute garbage of the labour party proposed unrealized capital gains tax in Super, it is so deeply flawed and poses significant risks to the economy and individual investors. Valuing assets that are not frequently traded is inherently complex and subjective, leading to disputes and inconsistencies in tax assessments. Taxing unrealized gains forces individuals to pay taxes on gains they haven’t actually realized, potentially disrupting their investment strategies and exacerbating market volatility. The administrative burden of implementing and enforcing this tax would be immense, adding unnecessary complexity to the tax system. This tax will discourage long-term investments, as investors might prefer short-term gains to avoid the tax on unrealized gains, and distort economic behaviour, leading to inefficiencies and unintended consequences in investment and business decisions.

I describe this as “absolute nonsense” and an “affront,” this policy will destroy the aspirations of younger generations trying to enter the build wealth within their super with the patient capiatal approach.

Once a tax like this gets into legislation, the reach is much easier across taxes on investment properties, ordinary shares, and eventually the family home by way of inheritance tax. This policy is not only misguided but also dangerous, threatening to undermine the very foundation of economic growth and stability.