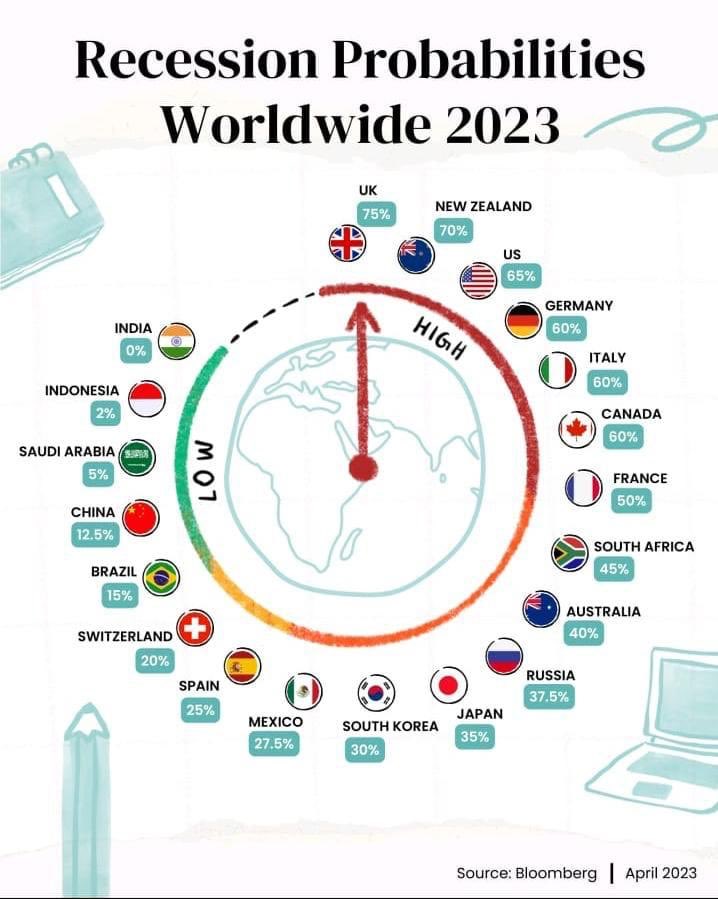

Hey folks, I am changing my post a little this time around, I usually dig into the global macro economy and what is happening with interest rates and what the big assets of property, shares and bonds might do as a consequence of the macro economy. I will keep it brief this time around but what is now obvious is we are in or entering an interest rate easing cycle globally. This cycle will add liquidity and will likely keep equity markets buoyant so buying dips is the consensus trade. Locally interest rates will be cut this month and maybe 1 more before Xmas, predicting 0.5% in total thanks to a low inflation print and jobless rate that is very low outside of government employment. (will save this for another time). While we do enter an easing cycle, I remain cautious on property investment and prefer credit for income and equities for growth. There are also very big headwinds on the horizon for investment property investors with negative gearing and cutting CGT discount. I would not be a buyer of investment property full stop.

So, instead, I am going to focus this post on my single largest holding in my portfolio and why I believe this is a potentially life changing investment. I have mentioned prior that concentration of the right investments is how you really can make a difference. There is a saying “diversification only leads to mediocrity”, there is truth in this statement and pending your time horizon and risk profile diversification maybe the right strategy for the over 60s. But for this post, I’m focusing why I am heavily invested in Imricor Medical Systems (ASX: IMR).

Many of you have heard me mention this company or have read my Substack posts where I may give a brief mention on Imricor. The back story is I got involved with this company 3 years ago and I have only ever accumulated more shares along the way. I will detail out here why. Firstly, Imricor is not so easy to understand business being a medical device company dealing with the complexity of heart surgery (more on that a little later) and it has taken me quite some time to really understand this business.

Spoiler Alert – Executive Summary or Abridged Version

If you want the short story, let me give you a quick summary in this section. Imricor Medical Systems is changing the game in fixing irregular heartbeats with MRI-guided tech that’s light-years ahead of old-school X-ray methods. Sure, the share price dipped from A$1.70 to A$1.20 recently, but that’s just noise—a new institution who came in during the March raise at $1.41 dumped 2.6 million shares between $1.55 and$1.20, spooking some weak hands into selling.

The core story hasn’t changed one bit, and with a recent capital raise of A$70 million in the bank, Imricor’s is well capitalised and has no intention of raising any fresh capital. The long term story remains compelling. If you’ve read my Substack, you know the best investors play the 7–10-year game, and this is one to hold tight.

I’m calling a Speculative Buy with a A$4.00 target in 2 years (August 2027) and a A$30.00 target within 10years. Here’s why.

What Makes Imricor Special?

Here is a quick understanding AFL vs VT – The key difference between AFL (Atrial Flutter) and VT (Ventricular Tachycardia) heart operations is where the abnormal rhythm starts: AT procedures target the upper chambers of the heart (atria), while VT procedures focus on the lower chambers (ventricles), which are more serious and often require more complex treatment.

In plain terms: AFL is like fixing a glitch in the heart’s upstairs wiring, while VT is repairing a fault in the downstairs power system, which can be more dangerous.

Picture a doctor trying to fix a racing heart with blurry X-ray images—tough, right? That’s why traditional ablation procedures fail 40–50% of the time for tricky cases like ventricular tachycardia (VT).

Imricor’s MRI-guided platform gives doctors a sharp, real-time 3D view, letting them zap exactly the right spots with no radiation and no need to wear heavy lead to protect themselves. European clinical trials showed 100% chronic success and almost twice as fast as conventional atrial flutter procedure with X-Ray mapping guidance. The time difference was 50% reduction in surgery time. to just 48min vs 88mins for AFL. But hang on what about VT this surgery can take between 5 and 8 hours with a supported success rate of around 50%. Imricor recently started its clinical trials for VT and early results are showing a 50% reduction surgery time and a 40% higher success rate when compared with X-Ray guided surgery.

Top doctors like Prof. Gerhard Hindricks at Charité University Hospital call it a “game-changer,” and Dr. Marco Götte in Amsterdam says it’ll be the new standard.

Why the Price Drop? It’s a Gift

The recent slide to A$1.20 came from an institutional seller offloading 2.6 million shares, causing a mini panic. Some folks bailed, but as I’ve said on Substack, great investors stay calm when the market overreacts.

Imricor’s fundamentals are rock-solid—nothing’s changed about its tech, market, or growth plan. This dip is your chance to add to your holding or if you feel you missed the boat NOW is the time make that investment.

The Tech: A One-Two Punch

Imricor’s NorthStar Mapping System is a 3D software tool that helps doctors perform heart procedures using real-time MRI imaging instead of traditional X-rays. It allows precise visualization and tracking of catheters inside the heart, guiding treatments like ablation for arrhythmias. NorthStar integrates directly with MRI machines, offering safer, radiation-free procedures with high-quality imaging and efficient workflow. It also supports training and simulation and has recently received CE Mark approval for use in Europe.

NorthStar’s core strength lies in its ability to provide real-time, high-resolution 3D MRI-based navigation and visualization. This capability is not limited to cardiac procedures. Many surgeries involving internal organs—such as the brain, liver, kidneys, or prostate—require precise targeting, real-time feedback, and minimal invasiveness. By adapting NorthStar’s MRI-guided catheter tracking and mapping technology, surgeons could perform interventions with greater accuracy and safety, avoiding radiation exposure and improving outcomes. Its vendor-neutral design and integration with MRI control systems make it a flexible platform that could be extended to support tools like biopsy needles, ablation probes, or robotic instruments across a range of specialties, from interventional oncology to neurosurgery.

How They Make Money

- Upfront Sales: Hospitals pay USD $500,000+ for MRI-compatible lab equipment.

- Repeat Sales: Disposable catheters USD $4,000 for simpler procedures like atrial flutter, USD 6,500 for complex procedures like VT and Afib)

- At 500 procedures per annum per lab generates recurring revenue of $3m per annum

- With 7,500 heart labs worldwide, grabbing 10% (750 labs) by 2033 could mean USD 2.5 bn in revenue.

Where They’re At

- Imricor’s in 10+ countries, with approvals in Europe, Saudi Arabia, and Qatar.

- They’re running FDA trials at top hospitals like Johns Hopkins, with independent research analysts expect the number of hospitals to be in the hundreds within next 8 years.

- Partnerships with MRI manufacturers Siemens, Philips, and GE Healthcare are speeding things up.

- Imricor raised A$70 million (US$44.1 million) at A$1.41 per share, issuing 49.6 million new shares (total shares on issue 320 million).

- With A$78 million (US$50 million) in the bank at June 30 2025, they’re fully funded for US expansion, new approvals, and R&D on tools like biopsy catheters (think North Star)

Cash to Burn: No Worries Here

Imricor raised A$70 million (US$44.1 million) at A$1.41 per share, issuing 49.6 million new shares (total shares on issue 320 million).

With A$78 million (US$50.35 million) in the bank at June 30 2025, they’re fully funded for US expansion, new approvals, and R&D on tools like biopsy catheters (think NorthStar) —no more fundraising needed.

Funds are being used for growth with an increase of staff, but not more engineers. The greatest growth in the sales team adding 6 sales reps who are working now on sales strategy for 2026.

What’s It Worth?

Here is my conservative approach

By end Calander 2027 Imricor will have 1% market share of a $16B global market being US $160M at 5 times revenue multiple (this is super conservative) gives US $800M or circa $1.3B AU market cap with AU share price approximately of $4.00

By end Calander 2033, Imricor will have 5% market share of a $25B global market being US $1.25B at 5 times revenue multiple (this is super conservative) gives US $6.25B or circa $9.6B AU market cap with AU share price approximately of $30

How Imricor Stacks Up

At current valuation of USD 220 million (A$400 million at A$1.25), Imricor looks compelling when compared to: some comparable MedTech firms at the same stage of their cycle.

- Shockwave Medical: Grew revenue from US 1.7 million (2017) to US 12.3 million (2019) and market cap was 1Billion, by 2023 revenue was US 730.2 million, and it sold for USD 13.1 billion in 2024.

- Pro Medicus: Went from AUD 31.6 million (2016) and market cap of $350M (10X) In 2024 revenue was $161M and AU market cap $22 billion in 2025 (136X)

Imricor’s USD 700 million revenue by 2033 could put it in Shockwave’s and Promedicus league and arguably a new premier league

Risks to Keep in Mind

- Approvals: FDA sign-offs could slip, Imricor, recently announced a delay with US FDA approval, not through any fault or concern but simply a reviewer (person within the FDA) had resigned, and a new reviewer was appointed but would need extra time to catch up on the knowledge of this approval.

- Adoption: MRI labs cost USD 3 million to set up similar to the cost to establish a new X-Ray lab.

- Competition: Big players might try catching up, but Imricor’s patents buy time.

- Global Market Turmoil: More selling could keep things choppy.

Why I’m All In

- Imricor’s got a unique shot at a USD 5-15 billion market cap within the next 10yrs

- The US50 million cash pile means no dilution

- No value being ascribed to NorthStar mapping technology

- With Shockwave and Pro Medicus showing what’s possible, Imricor could be the next big global Med-Tech

Disclaimer

This information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, you should consider whether the information is appropriate in light of your particular objectives, financial situation, and needs.

Authorised Representative (AR) Disclosures:

- Disclosures should include the following:

- Licensee Name and AFSL Number

- Licensee ABN

- Corporate Authorised Representative (CAR)

- Name and Number (if applicable)

- Authorised Representative (AR) Name and Number (if applicable)

- Contact details, including business email and phone number.