I know many of you enjoy reading my “The Good Fellas Way” updates on global macro investing and asset allocation. So, my apologies for the pause since the last post. In fact, my last post occurred seven weeks ago, and in that post, I suggested that markets could go higher, and indeed they have.

Equity indices such as the S&P 500 and ASX 200 are up approximately 4% to 5% in the last 6 to 7 weeks. Interestingly, though, NASDAQ has underperformed in comparison, with only a 3% increase, and Bitcoin, the riskiest asset class on earth, was actually down 13% from $30k USD.

My quick take on this is that the rally that started in mid-June 2022 (and was retested in October 2022) is running out of steam. However, you will always want to look at the fundamentals and technical analysis before acting.

While I was away, I travelled to Europe. Having visited Europe many times over the summer, it was obvious that Europe was in a recession. Despite all the headlines, not many people travelled to Europe this summer. It just wasn’t that busy. Hotels, restaurants, beaches, and daybeds were all available. The shopping mecca of Milan was well mildly…. busy, but nothing like it should have been in August. Beaches that are normally packed just weren’t yes busy but not packed.

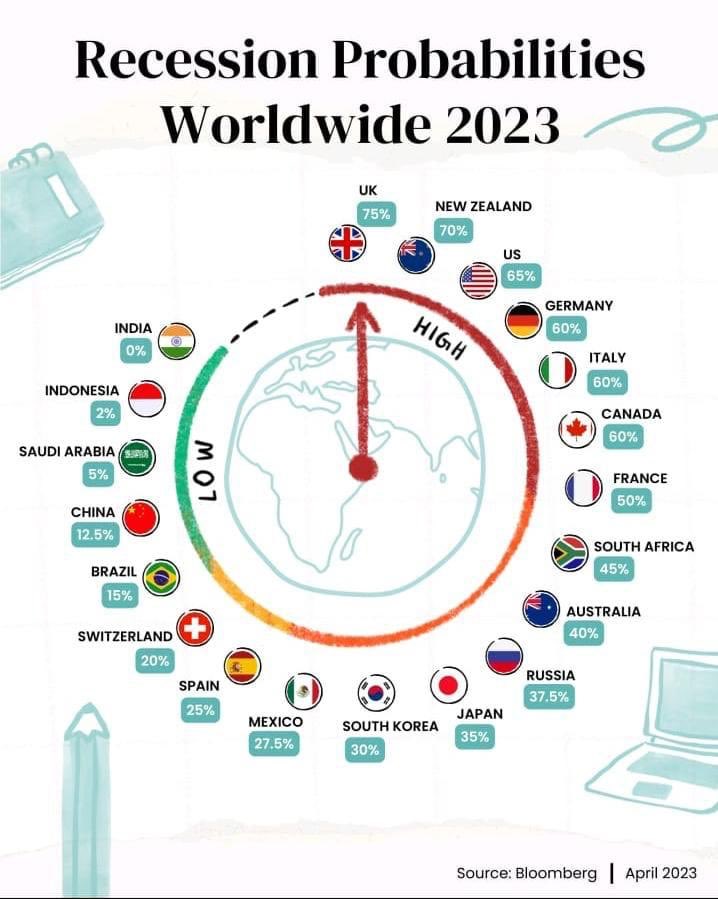

This got me thinking about what do the economic numbers show against my anecdotal evidence as a traveller. Well, when I look at the leading economic indicators of the eurozone, it confirms my understanding of the euro economy, and I predict that Europe will be the first major economy to report a recession in 2023. When I look at leading indicators (see below), the grey line indicates prior recessions, and the blue line indicates the leading mix of indicators.

In the USA, the economy remains quite buoyant, with stronger-than-anticipated nominal GDP growth of +6.2% and real GDP growth of 2.4%. The difference between nominal and real GDP is the inflation measure. After posting such positive GDP figures, analysts everywhere have factored in a soft landing and even a new bull market. I note that Goldman Sachs and a cohort of analysts have assigned just a 20% chance of a recession in the US.

Is everyone buying into this optimistic outlook?

US homeowners are now mortgage prisoners as they can’t sell due to the historically low mortgage rates they picked up post-pandemic.

Bloomberg reports that 40% of all homeowners have mortgage rates at or around 3%, and Goldman Sachs reports that 90% of all home loans are below current rates. This has resulted in a large cohort of people not buying new homes. While newly built homes are strong for now, there is a massive gap in the forecast for the construction of new homes. Initial new homes can’t pick up 40% of the sector that might have upgraded their homes. I think this will become a headwind for the US economy over the next year. Let’s look at another headwind that’s not much talked about.

Starting October 1, the US Government’s moratorium on student loans will end. This debt stands at nearly 1.7 trillion, with an average debt of $38k for 43 million students. This will drain yet more free cash from consumers. Looking at corporates, I note that US bankruptcy applications are the highest since the Global Financial Crisis (GFC) in 2008.

Turning to China, its economy seems to be moving in one direction due to the property cycle and the associated debt in this asset class.

China is making desperate attempts to stimulate its economy. GDP has fallen from 7% to just 3.5% in the last 10 years, with a clear downward trend. China has reduced its prime lending rate to just 3.45%, the lowest in 10 years, down from highs in 2013 of around 5.8%. It has also injected liquidity into its bond market, which is not a positive sign.

The UK is likely to follow Europe’s lead. It’s hard to see how the UK grows while the Euro is weakening.

Finally, in Australia, the economy is quite patchy, with interest rates having a significant impact. The mortgage cliff, peaking in January 2024, will likely drive another wave of real estate sales. Those who wish to hold onto their properties will likely spend less, leading to an even weaker economy in 2024.

So, where does all this leave us in terms of asset direction? As my headline suggests, “If you’re not a contrarian, you’re a victim,” which is a great saying for investing that often yields rewards. I always look for consensus views and remain open to different perspectives. While every global bank analyst, as a cohort, gives less than a 20% chance of a recession, can the USA truly be immune to the rest of the world?

Perhaps the reason the US maintains GDP growth is due to the significant fiscal spending the government is injecting into the economy. The ironic situation is that as they stimulate fiscally, they also have to raise interest rates to control inflation. By the way, have you seen the oil price over the last six weeks?

It has reached $100 a barrel, which is inflationary and may trigger another interest rate hike in the US in November. In my view, it’s prudent to move against the consensus of a perfect “no recession” mantra and position for a US recession in line with the rest of the globe. The depth of the recession will depend on various factors, and it’s impossible to predict. Still, typically, if something breaks, it will be in economies experiencing a recession, leading to contagion.

As I’ve mentioned before, I want this piece to be actionable or productive for you.

In my last post, I communicated that I would share my asset allocation and positions. So, how do we best position ourselves for a weakening global outlook? The simplest way is to stay in cash, or for the more adventurous, you can consider buying the Vanguard Australian Government Bond Index. It would be prudent to mix cash and match the two assets. You will achieve a risk-free rate running at approximately 4%. The purpose of the bond is to profit from the inevitable interest rate cut cycle as you can achieve capital appreciation on your bonds. Below, I have provided my current asset allocation.

We have begun allocating a small portion, 6% of the portfolio, to the property sector. Australian Real Estate Investment Trusts (REITs) have faced challenges recently, primarily due to higher interest rates and the shift towards remote work, causing this sector to trade, on average, 20% below its net tangible asset value. I also note that many trusts have yields of 6% or more. I anticipate this discount closing in the coming years and am considering increasing our allocation to this sector should prices weaken further during a global recession.

In the past month, we have also increased our allocation to the private debt and credit asset classes. We’ve allocated to the MA Sustainable Fund, offering an annual return of 11%, as well as the Pepper Money Bond at 10.8%. Additionally, we’ve engaged in a standalone private credit deal, providing a 9.8% return over a one-year period. This deal involves holding a first mortgage with a 63% loan-to-value ratio.

Equities do not appear to offer significant value in the current market environment. While we hold a few small-cap positions that may surprise us in the coming year, our overall allocation to equities remains very low. We are actively watching for signs of market disruption or the “something breaks” scenario before considering a shift from cash into equities.

Our portfolio also includes a 5% allocation to Crypto through a fund. In the short to medium term (3–9 months), I anticipate a potential decline in Crypto prices, contingent on the recession outlook. However, beyond the next six months or so, I hold a bullish view on Bitcoin and Ethereum, believing that this asset class could potentially experience a tenfold increase over the next decade.

To protect against and possibly profit from a decline in asset prices, I’ve implemented a special trade by purchasing an S&P 500 June 2024 4000 put option, costing $9.00 or $1400 AUD, with a nominal value of approximately 66k AUD per lot. Given the current price of $4430, this hedge, or insurance, provides added confidence in allocating to equities as markets undergo declines.

Stay tuned for my next post, where I will research the next best long-term trade beyond Crypto.

If you like my posts and you think someone else would be interested in or benefit from them, then please share my Substack link here: The Good Fellas Link