Financial Markets are incredibly tough to predict, as evidenced by my year-long view that the fastest interest rate increases in nearly 50 years would have an impact on asset prices. Just last month, I suggested that it was best just to “Sell in in May and Go away. If you recall, that theory relates to a lack of volatility and participation, which tends to lead markets to drift lower, statistically by 6%, but of course, not every year. Well, since that last post on May 22, US Indices are on average up 6%. This sharp rise in just a month is what’s known as a “melt-up”. It is also for traders. It’s also called the pain trade. Professional traders are on the wrong side of the price movement and wearing a lot of pain on the PNL. Fortunately, for me and for you, we are not in the business of trading, as we would be feeling that pain trade ourselves.

But not all, is what it seems, the concentration on the Mega Caps stocks( Apple, Microsoft,Google Facebook and now Nvidia) on the indices is masking the real broader global asset performance.

The chart below shows a 1-year look back on global indices. The standout performers are Nasdaq and S&P 500 at 30% and 15%, respectively, with the Euro and Australia performing admirably, but if you look at the emerging markets and particularly China (the 2nd largest economy in the world), these are flat to negative to 3%. Also, look at the recent steepness of the selloff in the last month in the bottom four indices.

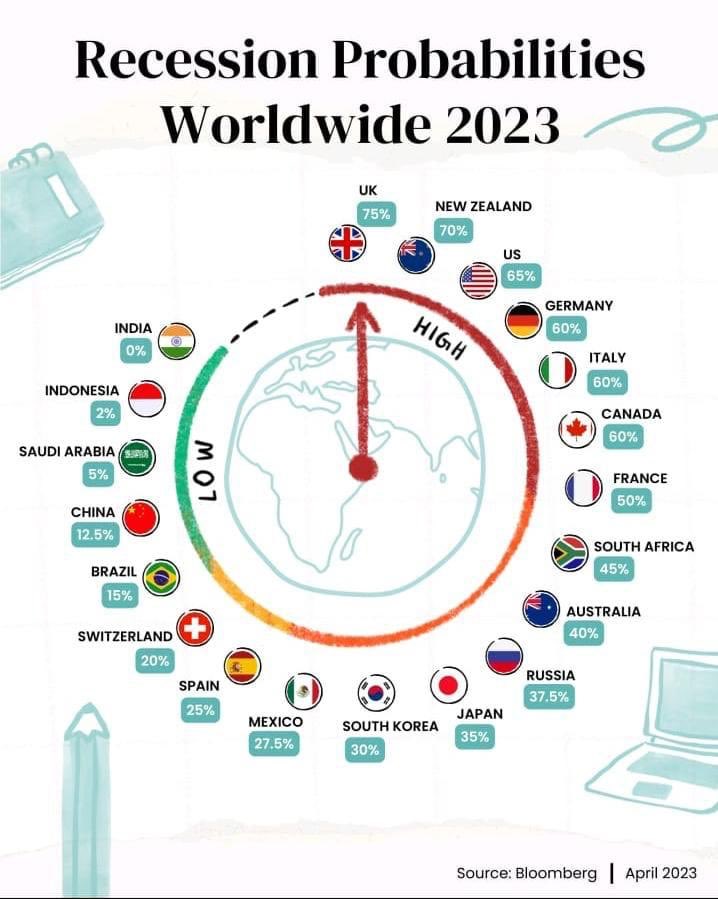

I maintain my view that this bullish sentiment will ultimately fail; it’s just that in today’s world, we all expect things to happen instantly, and now, more than a year after our first interest rate hike, we should be seeing that forecast recession. My research, when looking back at the time lags from the initial inflation-fighting rate rise cycle to an actual recession, is identified over three periods: 1987-1989, eighteen months, 1999–2001, twelve months, 2005–2007, and twenty-one months. We are now sitting at fifteen months.

I then had a look at what happened to asset prices during these tightening cycles, and it was a surprise to me that the Dow Jones Index had rallied 52% from Sep 86, coinciding with the start of a tightening cycle until the spectacular 1987 crash in Oct 1987 known as Black Monday. Move forward to Jun 98 tightening cycle and rally exceeds 35% before collapsing in the tech wreck in May 2001 and finally, May 2004, up 44% to July of 2007. (but this was a much slower pace of rises and explains the duration exception. The point I am making is we only have history to guide us to what might happen this time.

As I made mentioned in my previous posts, I am wrong in my view (at least for now) that the fundamentals of tighter credit conditions and higher input costs from interest rates to wages combined with a weak global growth will lead to a global recession in my view this be some time in 2024. Inflation will ease but over this next 12 months that is for certain but don’t be fooled that lower inflation will mean interest rates cuts come with it.

Talking of recessions, there is a genuine cohort of young Australians (let’s say under 35 years) that arguably have never experienced a recession, the last one occurred in 2008 and many were new into their jobs and quite likely had little to no impact on their position, sadly this was not the case for me. I was let go from my high paying job at Macquarie Bank in the very depths of 2008. It took me a couple of years to find my way on what I wanted to do next, and many colleagues and friends were without employment for months, if not a years many left the industry. So it is not that I wish for a recession but I write this post with the view, you will learn form it and maybe provision for it and certainly refrain from irrational exuberance on your spending.

You will note that my posts have a global macroeconomy lens but this month I want to focus in on the Australian economy. It is now pretty evident in the media that we are 50/50 on a recession within the next 12months, I put this 80% and here are the reasons why:

Firstly the mortgage rate cliff is yet hit the majority of borrowers, the peak expiry of the fixed 3 year interest rates is not until this time next year. These increase are not insignificant, we are talking about mortgage payments more than doubling for 15% of borrowers. It very interesting that the Banks this last week have announced that have had to abandon the 3.0% buffer on borrowing rates and the reason being is many home owners that will refinance post their fixed rate expiry will see many borrowers fail this test for servicing. Its laughable a measure to protect bank capital is abandoned for the benefit of borrowers, it this a kick the can down the road and hope rates fall, this smells of reserve bank influence.

Two, in the five years leading up to the GFC real wages tracked a positive 6.2% per annum increase while real wages from 2018-23 is negative 5.3% that a whooping 11.5% difference and while we catching up on wage growth it wont happen fast enough as company executives look at what is ahead.

Three, in the GFC we had China come to the rescue with monstrous stimulus of $586 Billion which directly benefited our economy with the China property boom that lasted 10 years. Efforts thus far from China is an easing of monetary policy and they are loathed to go and build more overpriced apartments in ghost cities.

Four, New Zealand which was ahead of most developed nations in the tightening interest rate cycle has this month entered a recession, its cash rate is at 5.5% vs Australia ay 4.1% and its worth noting NewZealand House prices our down 17.5% vs Australia at 10%.

Lets assume then we go into a recession and what does that mean for investing and what are the immediate steps we can take. I have said for a year that it was time to go fishing and do nothing, asset allocation should be mild and targeted or compelling investment opportunities.

The smartest thing you can do right now is to push every available dollar to debt reduction and if that’s a mortgage you are getting a real return of 6.0% and it’s risk-free. If you don’t have a mortgage (lucky you) then liquid fixed-income investments are where you might direct your capital.

Back to markets: until last week, I noticed that Crypto wasn’t in tune with S&P and Nasdaq’s recent price rises, I mention this as Crypto is the riskiest asset on earth and so can be early indicator on global risk appetite for investment. This breakdown in correlation had me leaning on my own confirmation bias that my view that we are close to a top might be right. Well, that got blown out of the water as Bitcoin held support at $25k USD and broke $30K and is now up 85% year to date. (Chart Below). I have mentioned here a number of times that I believe in Bitcoin and, albeit to a lesser extent, Ethereum, forgets the eleven thousand of altcoins or better known as shit coins. I own these two assets as part of my portfolio.

If you are thinking of allocating, please be very careful of the exchange you use to acquire your crypto. I prefer to use BTC Markets, an Australian crypto exchange. Remember, this is a small allocation of your investable assets, and it’s a generational play, so maybe consider dollar cost averaging over time.

I remain of the view that it is not yet time to be investing in high-growth risk assets like tech shares. Last month I suggested Australian REITS look interesting, and we have allocated to this sector. This month we have seen some comparable sales in the commercial sector, which are down 20% on valuations, but maybe better than the market expected. We like Industrial property only but will keep commercial on the watch list. We are allocating to fixed-interest and asset-backed loans; we achieved a blended yield near 8.0% with various payment cycles from monthly to quarterly and our fixed-income government bonds on a biannual basis.

We have also made some small strategic buys of shares that are in the tax loss selling zone ahead of June 30. This leads me to a new development with The Good Fellas Way investment posts. I will, from now on, share my investments and trades with you. Please note that these will be historic.

You shouldn’t act on these trades without seeking advice from your advisor or at least doing your own research. From July 1, I will keep a record of our investments and the performance of our portfolio and share this with you. As I have commented numerous times here, I want all my readers and listeners to learn from my thirty-plus years of investment and business experience by sharing my asset allocation. I hope you might be better informed.

I want to give a special mention to the assistance of the research this month to Alf Peccatillo, The Macro Compass, and Tarric Brooker, The Avid Commentator.

If you like my posts and you think someone else would be interested or benefit, then please share my substack link here The Good Fellas.