Let’s first explain what is a “Minsky Moment” ……A Minsky Moment refers to the onset of a market collapse brought on by the reckless speculative activity that defines an unsustainable bullish period. Minsky Moment is named after economist Hyman Minsky and defines the point in time when the sudden decline in market sentiment inevitably leads to a market crash.

Back in September of 2022, I wrote that we could be approaching a once-in-decade opportunity to acquire assets at historically favourable prices. Well, 6 months forward, we have not seen any material price decline. In fact, we are higher than where we were last September in fact, and we are only 10% off all-time highs in the ASX and 12.5% in the S&P 500. Back in September, the economy was running inflation above 7%, Interest rates were rising, and unemployment didn’t exist. When it came to mortgage interest rates, I forecast a new normal of 5%-6%. I warned that interest rates would be higher for longer, and I suggested that the only way rates could fall from these levels as if something broke.

Well, we are seeing things break first the UK Bond Market in December and now some smaller US banks and the biggest and oldest Swiss Bank Credit Suisse. So things have been broken in these last couple of weeks. We have seen a run on smaller regional banks in the US. The run started with Silicon Valley Bank servicing the technology and venture capital industry. It quickly spread to Signature and Silvergate Banks out of New York Bank; these banks courted the crypto industry. These bank runs have been momentous, and had it not been for the US Federal Reserve, we may well be in a remake of the 2008 GFC.

But like a white knight, incomes the US Federal Reserve to the rescue. Let me share some knowledge and dig a little deeper into these bank runs and how the Fed backstopped a banking crisis.

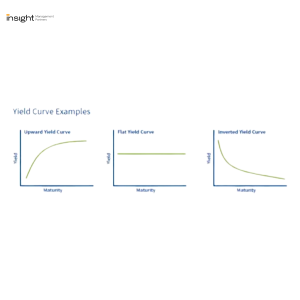

In basic terms, all banks work on what is known as fractional banking, and what this means is a bank will only hold a fraction of its customers’ deposits in actual cash (ready for withdrawal). They then use this cash to make loans or invest in longer-dated investments. A bank’s basic modus operandi is to borrow short and lend long. But in this last year, we have seen the greatest increase in interest rates in 40 years as a consequence of the highest reported inflation in 40yrs… this has changed the yield curve on interest rates from contagion to inverted, and what this means is shorter-term rates are higher than longer-term rates. Well, that is the exact opposite model for the bank’s profitability. Banks can withstand an inverted yield curve for the short term, but we are now a year-long on an inverted yield curve, and that yield curve is actually steepening the wrong way.

In March, Silicon Valley Bank had a run on their bank (meaning customers wanted their deposits back). The problem for SVB was its customers’ deposits were invested in government bonds and mortgaged back securities. These are AAA-grade investments, and they are very liquid… BUT SVB bank had accumulated significant deposits back in 2020-2021 with VC technology funds, and they invested these funds in bonds and MBS (mortgage-backed securities) that were yielding just 1.5%. Well, these bonds are now closer to 5%, and sell these assets and repay their customer deposits, they must take a loss, and it is these losses that had the bank quickly become insolvent. This is the largest bank failure since Lehman Brothers in 2008.

In March, Silicon Valley Bank had a run on their bank (meaning customers wanted their deposits back). The problem for SVB was its customers’ deposits were invested in government bonds and mortgaged back securities. These are AAA-grade investments, and they are very liquid… BUT SVB bank had accumulated significant deposits back in 2020-2021 with VC technology funds, and they invested these funds in bonds and MBS (mortgage-backed securities) that were yielding just 1.5%. Well, these bonds are now closer to 5%, and sell these assets and repay their customer deposits, they must take a loss, and it is these losses that had the bank quickly become insolvent. This is the largest bank failure since Lehman Brothers in 2008.

The US Fed stepped and saved the entire banking system with yet another emergency tool for immediate liquidity injection to take the bonds and mortgage-backed securities and mark these assets at full value (not market value); they also assured customers their deposits would be guaranteed. This didn’t save SVB, but this move did support the 11,000 other regional banks and averted a US bank run catastrophe. The US banking system is very different from our own banking industry. For a start, these smaller US Regional banks don’t have stringent stress testing and capital reporting requirements. While there would be market fallout in the banks globally, it would be naïve to suggest Australia, Europe, the UK, or Canada would have the same problem.

Nonetheless, the contagion of the US banks flowed on to Europe, with Credit Suisse failing and needing rescue from the Swiss government, forcing UBS to make an acquisition of Credit Suisse with some very favourable terms. As I write today, the focus is on Deutsche Bank, which has wobbled.

So despite the sign of things breaking, equity markets are looking strong… and the reason why is the market is anticipating some significant rate cuts in the coming 6 months….. and with that, a return to super low rates and free money… forever. Hip, Hip Hooray!!!

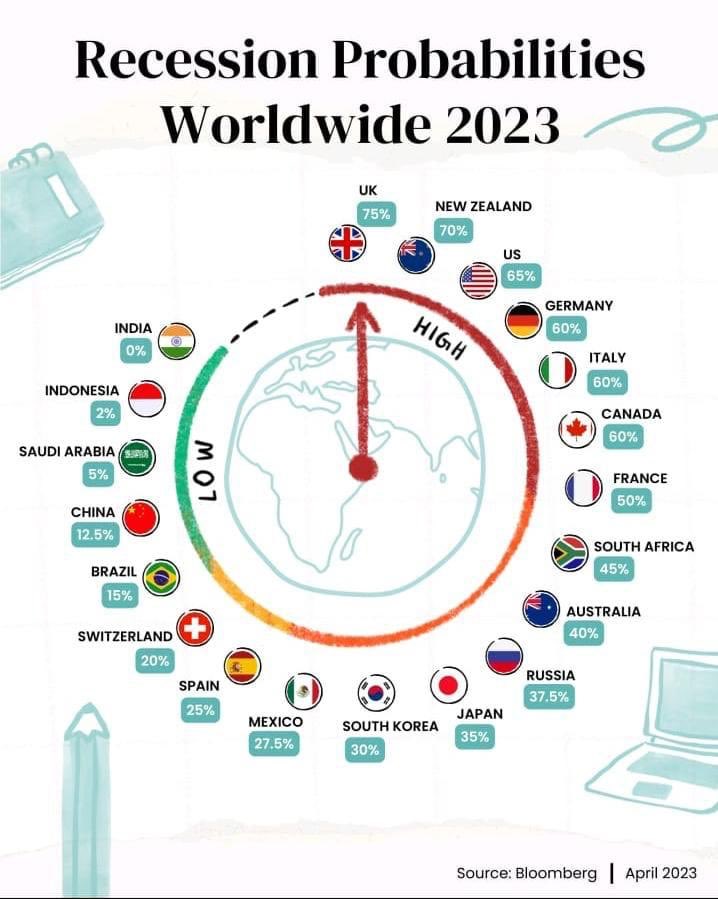

But I just don’t buy this position.. and maybe we are heading for the Minsky Moment… I just can’t see how company earnings hold up in a recession (that is yet to play out, but it is coming). The S&P today is trading at 22 times earnings off a long-term mean of 16. To get to these forecast rate cuts, we need to see the actual decline in the economy and disinflation to justify the cuts. Well, look around. We are just not there Inflation in USA/ AUS/ Europe is all above 6.0%… so it higher for longer, but yes, we will get these rates. I have attached a chart below that, in my view, highlights where we are at “return to normal”

courtesy of Ponzi Finance Twitter @BP_Rising

But, the higher for longer comes with its risks, and from what I understand, there is risk in the US $20 trillion dollar commercial real estate sector, and I see this as the next shoe to drop. The US regional banks ( the same banks that are under pressure today) hold 65% of all commercial real estate loans… which is enormous. Cracks are appearing Blackstone ( the largest alternative asset manager) recently defaulted on a $3OOM commercial loan. THE AFR reported just last week that buildings in San Francisco are being handed over to the lenders, with owners wiping out their equity. Commercial Real Estate has vacancy rates exceeding 15%, and re-leases or renewals are coming in at 50% below the previous lease; why…..the work from home is a paradigm shift that will see some spectacular failures and add to bank woes.

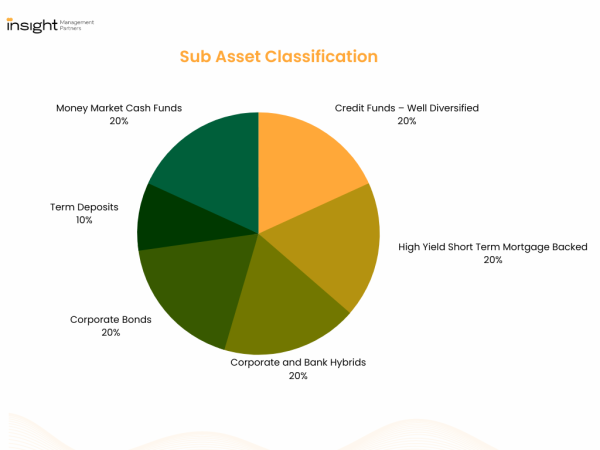

In my last post, I wrote it’s time to go fishing, and I remain of that view for now, but if we do see the economy weaken. We see more events that weaken asset prices than you want to be nimble and be ready to participate, and it might be we look to the banks and investment in the commercial real estate sector. I also said in my last post it is a good time to invest in fixed interest for longer-term yield… we know that over the next 2 -3 years rate will be lower. So let’s now allocate to this sector; when I look at this asset allocation break this to break this down into sub-asset classes that have a mix including:

To close, Crypto, and specifically Bitcoin, has and is having a big run. The theme behind this strength is the banking collapses and the security of your own custody, and of course, the forecast for rate cuts. I can’t get bullish on Crypto at these levels with the risks identified here in this note, but I am very much a long-term believer that you should own some Bitcoin and have a 10yr investment horizon.

I will leave you with my mantra .. you can only manage one thing and that is the risk you take. Hope you got something out “The Good Fellas Way”